Investing in Mozambique’s Property Market

Article By Jacqueline Gray 14 Dec 2011

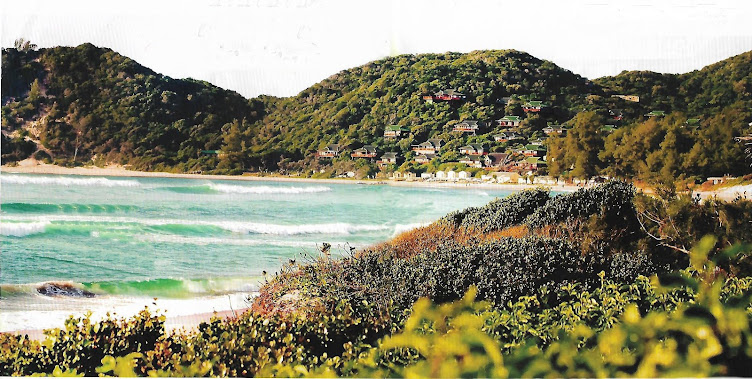

Mozambique has become a popular tourist destination in recent years. Property development companies have cottoned on to the country’s inherent potential and Mozambique is now fast becoming a sought after property investment destination. The small town of Ponta do Ouro in southern Mozambique is but one of the outposts benefitting from this new found interest. Evidence of this is manifest in the fact that within a few short years a number of gleaming new houses have mushroomed in and around the town alongside the decaying war scarred properties which, while still in evidence, are now in the minority.Ponta do Ouro is popular with surfers and divers who come to the area to take advantage of the good surfing conditions and pristine reefs. Other pastimes in the area include snorkelling, swimming, four by fouring, quad biking, kite boarding and dolphin encounters. The town features a craft market and a few restaurants but a supermarket has yet to take up residence. As such, most residents shop in Maputo. A proposed road from Ponta do Ouro to Maputo may soon fast-track such trips considerably.

One property development company which is making its mark in Ponta do Ouro is the Coral Palm Development Corporation which entered Mozambique in 1992. Since its debut, this company has built over 80 holiday homes and is involved with the refurbishment of various hotels, lodges and businesses. Coral Palm also currently offers a variety of exclusive developments including Mar e Sol, Vista Alta Spa & Lodge, Ntusty Lodge, Praia e Sol and La Vista - an exclusive share block venture. Additionally, Coral Palm markets a variety of exclusive stand-alone properties and commercial properties.

Kevin Lee Payne, CEO of Coral Palm explains how interested parties can go about investing in Mozambique’s property market. “Investing in real estate and/or associated businesses in Mozambique as a foreigner is relatively easy as long as the requirements are met and adhered to.

“Foreigners may own property through numerous vehicles such as a partnership with a Mozambican national; via an approved project or national company; through obtaining residency or through an existing development. Project authorization is required by the state prior to the construction of any project. The protocols for obtaining these rights is extensive and includes, amongst others, environmental impact assessments, architectural and engineering terms of reference and land impact surveys."

“Furthermore, all projects and/ or real estate acquisitions by foreigners in Mozambique must be secured and guaranteed by the state via registration of the project with the Mozambique State Centre for Investment & Promotion which then ensures that the Central Bank, the Ministry of Tourism and various other authorities provide authorisation. Following this, foreigners can enjoy benefits such as tax incentives, dividend repatriation and custom duty reductions.”

“Once a project is underway, strict inspections are conducted by the state ensuring that the project criteria are met. Upon completion a final inspection is conducted, following which a Provisional Land Title or ‘DUAT’ is issued by the state which entitles the holder to perpetual land-right usage if the project meets the requirements.”

Payne explains that there are alternative methods of obtaining land usage rights. One such alternative is to go the commercial route which entails obtaining tourism lodge or resort rights which entitles investors to renewable 55 year leases. According to Payne, such leases can also be converted into perpetual land use rights by applying to the state.

For those who don’t want to deal with the waiting periods and costs involved in trying to obtain land rights, it is recommended that they acquire property in Mozambique through buying into one of the established foreign owned and managed complexes. Coral Palm’s flagship Mar e Sol complex is a good example of the kind of development which might suit foreigners seeking to fast track their Mozambican property investment ventures.

Mar e Sol is an upmarket residential and holiday home complex situated on Ponta do Ouro’s main beach. All of the properties in this development conform to standard exterior architectural guidelines. The interiors are open to individual interpretation. Property prices start at R1, 5m and syndication options are available.

Payne says that South African investors can buy into Mar e Sol safe in the knowledge that it has been granted perpetual land rights and has been given the stamp of approval by the Ministry of Tourism. South Africa’s Reserve Bank has also approved the development.

In terms of the ‘big picture’, Payne says global economic conditions are only now beginning to take their toll in Ponto do Ouro. That said, interest overall remains strong. As for rumours about Zimbabwe style land grabs, he says only one incident has occurred in the country where a resort owner’s property was seized.

“In this particular instance the person in question did not comply with statutory requirements and the project was built without any state approvals. It was discovered that the land was being sub-divided illegally and sold to foreigners. Numerous written warnings were ignored, following which a court Interdict was obtained and the property seized.”

In Payne’s opinion, such rumours have been blown completely out of proportion and run contrary to Mozambique’s thirst for foreign investment. “Foreign property development in Mozambique is one of the strongest economic drivers in the country and the country cannot afford to put off investors. It is for this same reason that government has tightened up its land legislation. Doing so enables them to track exactly what’s going on and where and collect taxes accordingly. Happily, progress is being made in terms of attracting and streamlining foreign property development and Mozambique’s people are more than happy to welcome foreigners into the fold.”

Of course there is a lot more to Mozambique’s property ownership scenario than that which has been referred to here. For further information, contact property experts such as Coral Palm who are well versed in dealing with such matters.

Investing in Mozambique

Coral Palm Group 19 March 2012

Full Title and Perpetual Property Rights now allow Individuals and Investors unsurpassed incentives to invest in Prime Real Estate & Tourism Projects in Mozambique. The World Bank in its recent “World Tourism & Associated Economic Sustainability” report commented that Mozambique has recently become earmarked as one of the most potentially promising and economically viable tourism and development destinations on the East Coast of Africa.

Ponta D’ Ouro & Ponta Malongane in southern Mozambique in particular, has economically and socially progressed in leaps and bounds toward becoming, other than Sodwana Bay in Northern Kwa-Zulu, South Africa the most popular and busiest tourist destination between Durban and Mombassa. With over 260 000 tourists visiting these quaint seaside towns each year, the demand for accommodation and facilities has far exceed that of supply resulting in a magnificent opportunity for future development in Real Estate, Tourism and associated Projects.

Ponta D’ Ouro offers a host of amenities and facilities for the discerning tourist and recently has experienced a proliferation of residential abode refurbishment and construction. Municipal power supplies, fifteen resorts, telecommunication, water sports, luxury guesthouses, banking facilities, night-clubs, restaurants, game fishing and some of the best scuba diving on the east coast ensures unparalleled opportunity for further development and growth.

The areas remarkable diversity and unique combination of traditional African bush, sub-tropical coastline, sweeping coastal plains, savannah, dense forests, majestic inland lakes and pristine beaches and accessibility, make it one of the richest natural treasure chests in the world and creates a prime prospect for potential Investors and Speculators alike.

No comments:

Post a Comment